Are you tired of watching the odometer and trying to remember every work-related trip you've taken? Have you been searching for an easy and accurate way to track your deductible miles? Well, after months of feedback from tens of thousands of Solo members, we’re launching a new and improved mileage tracking feature called Trips!

Keep more and stress less with Solo!

As a gig worker, you're entitled to a tax deduction for the cost of operating your vehicle. The 2023 IRS standard mileage rate is 65.5¢ per mile, which means that if you drive 10,000 miles in a year, you can expect a $6,550 deduction from your gross income. That’s $6,550 of your yearly earnings that will now be tax-free! But how do you keep track of all those miles and ensure you're taking full advantage of these deductions? That's where the new Trips feature comes in.

How do I enable mileage tracking with Solo?

- Download the latest version of the Solo app.

- Enable 'always on' (for iOS) or 'allow while using' (for Android) location permissions in your phone's system location permission settings.

- Enable the 'Motion & Fitness' setting (for iOS) or 'Physical Activity' (for Android). This allows us to accurately auto-track your miles.

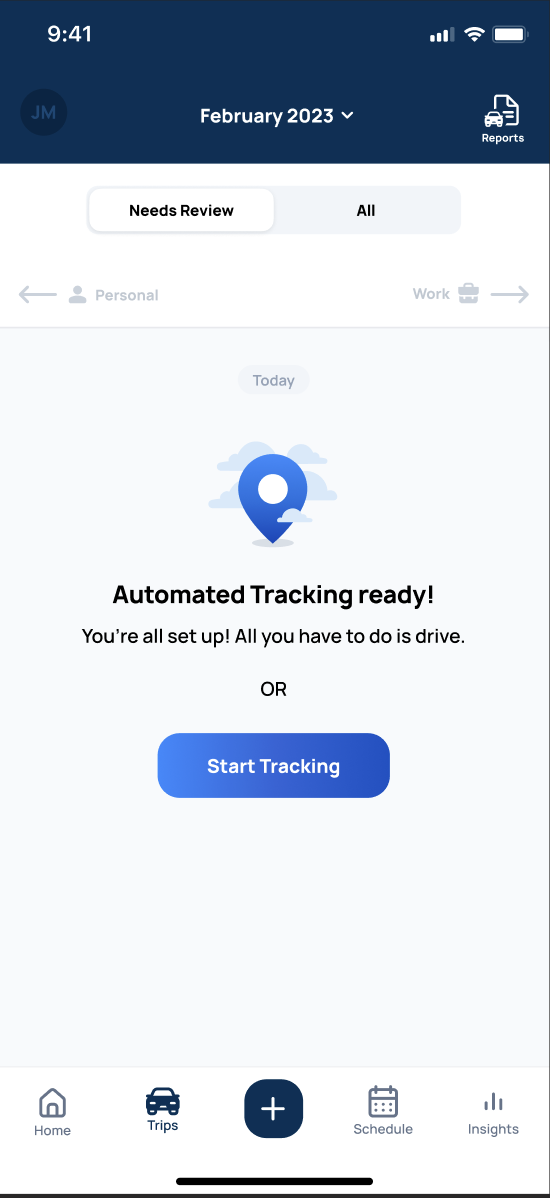

How to track your miles with the automated mileage tracker:

- Open the Solo app and make sure all your work accounts are linked. You can do this by navigating to the Settings menu and tapping 'Link Account.'

- Keep the Solo app on when you start working to ensure that Solo is tracking your miles accurately.

- Don’t close the Solo app while you’re out driving so that we do not miss any deductible miles.

- Until you've stopped driving for at least 15 minutes, nothing will be displayed in the 'Trips' section, as the best part of Solo is the fact that drive detection is automated!

- There's nothing to press to start or stop a drive —Solo has it covered.

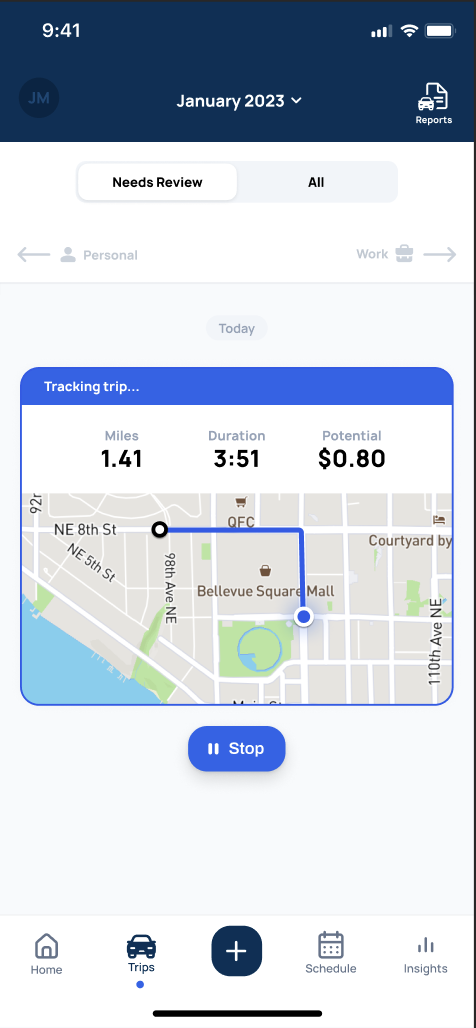

Want to track your miles manually and see your deductible miles in real time? Here’s how to use the manual tracker.

- Navigate to the 'Trips' feature. When you start working just tap 'Start Tracking.' From here you can see how many deductible miles Solo is tracking in real time.

- Don’t close the Solo app while you’re working (you can open and use other apps, though).

- When you’re done tap 'Stop.'

- Classify the trip and add notes for your own record.

How to classify working vs. personal miles:

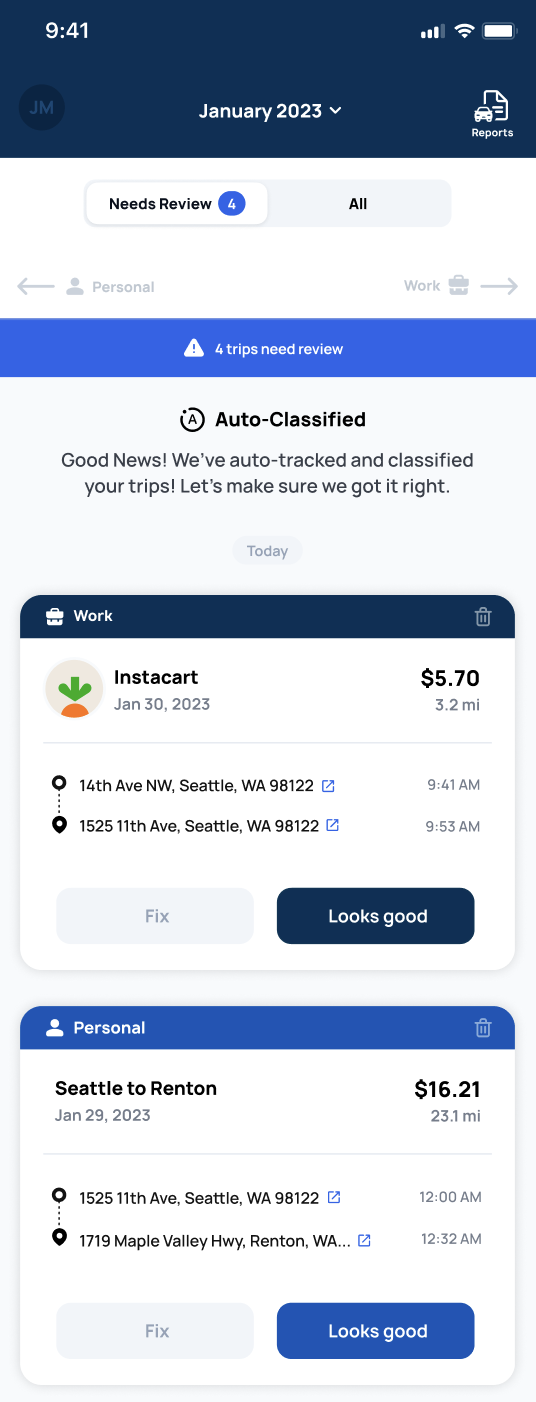

After you finish driving, allow up to 15 minutes, after becoming stationary, for the trip to be processed and delivered to the Solo mobile app. Usually this happens faster, but in areas with weak or blocked signals, it may take longer.

- Navigate to the 'Trips' feature and toggle the 'Needs Review' tab. You can review, classify and make edits to your trips here.

- If you see a trip that should be classified as a 'Work' trip swipe right. If it’s 'Personal' trip, swipe left.

- Solopreneurs who have their work accounts linked with Solo will have their trips automatically classified as soon as the work activity is processed and synced with Solo (this usually takes about 12 hours after your last work activity).

- After reviewing the automatically classified trip you can tap 'Looks Good' or swipe right to confirm the details.

Accessing past trips and exporting your trip log

- Go to the 'Reviewed' tab to access past trips. You can change the time period at the top.

- In order to export your Trip Log, tap 'Reports' and choose the time frame you want exported to your email.

As an app-based worker, one of the smartest things you can do to keep more is track your deductible miles while driving. Give the Solo app a try to simplify mileage tracking and automatically maximize your tax deduction! Plus, Solo software is tax deductible, so you can save even more. Reach out to info@worksolo.com with any questions or feedback. We're always looking to improve the product!